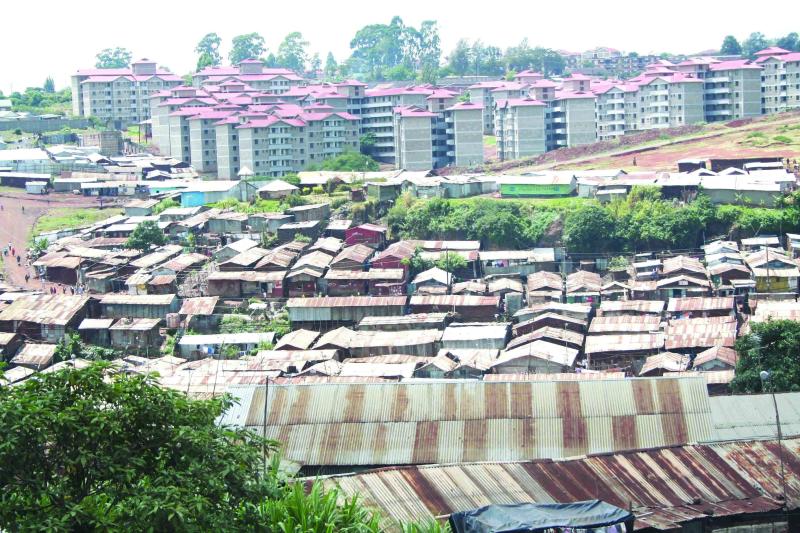

Nairobi is one of the most expensive cities to live in in Kenya. This is highly attributed to the residential houses, their location, transport, utilities, and taxes. For anyone living in Nairobi the secret to surviving in our so-called ‘shamba la mawe’ is in knowing how to budget your income so that by the end of paying all your bills you still have some money to save. In recent years rent for different estates and apartments has been on the rise. Given the increasing influx of population from rural and other areas in the scramble for the amenities in Nairobi such as learning institutions, commercial institutions, and jobs in the city, the demand for housing has been on the rise. According to a study done by Hass Property Index, apartments recorded the strongest growth over the quarter with asking rents at 2.1%, followed by detached houses at 1.7% and semi-detached houses at 0.9%. The average price for a room in Nairobi middle-class level is between Kshs.8,000 to Kshs.17,000. bedsitters range from Kshs.10,000 to Kshs.25,000 while a double room to multiple rooms ranges from Kshs.30,000 to Kshs.70,000.

Residential areas in high-end locations such as Karen, Langata, Muthaiga, and Kileleshwa, among others have a higher price ranging from Kshs.135,000 to Kshs.300,000 per month.

The choice of a place to live in Nairobi should always correspond to the mode of transport you expect to use. Since the covid-19 pandemic hit, transport costs have increased with the average person using kshs.200 a day to and from CBD using public transport. With the new regulations of covid-19 affecting the transport sector and also increase in the price of diesel, the cost of transport has also increased. In case, you are using taxis as a form of transport Uber charges an estimated Kshs.31.60 per km with personal taxis charging even higher than that. The cost of transport per month should always be included in your budget if you are a resident of Nairobi.

Basic utilities like phone charges, internet electricity bills, and water bills are extra bills to any person in Nairobi city. Water is scarce and to have it 24/7 in your residential area then you must spend pay for it. Food is also added to the list. It’s hard to get fresh farm produce in Nairobi and the restaurants and hotels around the city are expensive to most people.

To any employed person in Nairobi, taxes are a thing we all hate but we have to confer with. KRA takes their cut depending on the income you receive. Let us say you are earning Kshs. 15,000 every month. At the end of the month you pay a tax of Kshs.1410 to KRA, NSSF is Kshs. 900 as a pension plan and in case of health issues NHIF takes their cut of Kshs. 600 at the end of the day you are left with Kshs.12090 to cater for your rent, transport, food, and other needs till the next paycheck. The tax rates in Kenya are always on a rise, you always need to be on the lookout to balance between the earned income, the spent income, and the saved income.

To survive in Nairobi then you must be able to plan your money to the last cent. The residential area is a key aspect, if you are looking to pay less rent then it’s better to live a distance from CBD but near major roads, this may help save the rent money but the transport cost can be relatively high especially during rush hours. If you live walking distances from CBD it may help save on transport costs but most houses near CBD are relatively high on rent. So it is important to make sure to choose a living plan that is suitable for you. We all must eat but to manage your budget well then I advise it’s better if you get your food fresh from markets like Muthurwa and Gikomba where they can be assessed at a relatively lower price. You must always be able to estimate your spending cost, discipline yourself when it comes to savings since it is advisable to save at least a third of your income.